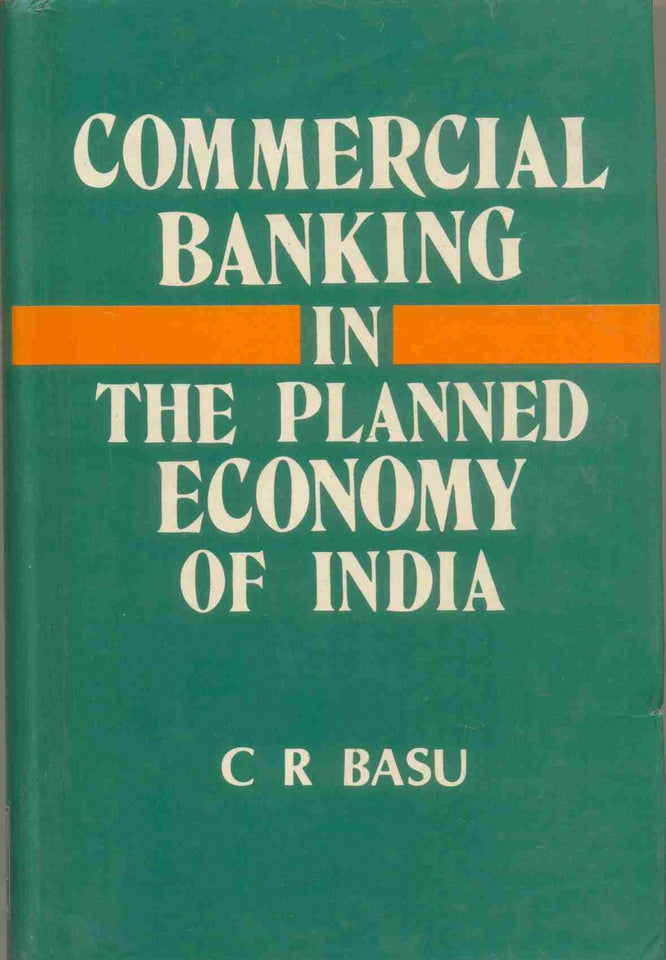

Commercial Banking In The Planned Economy Of India

Regular price

Rs. 375.00

This book, by integrating the fields of commercial banking with economic planning in India, presents a new understanding of the dynamic role which a versatile and percipient commercial banking system can play to aid the process of economic growth. Structurally, this work is divided into two parts. Part I endeavours to explore how the commercial banks in the pre-nationalisation period have drifted steadily from their orthodoxies to bolder policies in order to suit the structural requirements of a planned economy like that of India. This part analyses how the Indian commercial banks had provided the necessary financial base in the process of economic growth envisaged in the planned economy of India (1951-1968). These seventeen years of economic planning in India have witnessed a period of intense economic activity and the functioning of the commercial banking in India has acquired a new outlook with a new sense of purpose, direction and dimension in the context of planned economy. Since nationalisation in 1969 dramatic changes have occurred in the profile of Indian banking. The Part II portrays how the commercial banks have entered a new era of ?mass? banking in lieu of what was hitherto called ?class? banking in the post-nationalisation era (1969-1987). It evaluates critically the diversified role the commercial banks have been called upon to play, a variety of socio-economic responsibilities they have been assigned and also how they have emerged as a catalytic agent in accelerating the economic growth in the context of five year plans. This volume meets the needs of banking institutions to provide an authoritative text for trainees at the staff training colleges or zonal training centres. It would also prove indispensable for the Honours and Post-graduate students of commerce, management and monetary economics, the CAIIB examinees and in fact, any one who seeks to understand the basic issues in a planned economy and the ways in which commercial banking behavioural pattern and policy can stimulate and accelerate the process of growth.

Guaranteed Safe Checkout